MGM Resorts decides against new Entain bid

The US casino giant said that after careful consideration and reflection, it will not follow its initial proposal with a revised bid, or make a firm offer.

Under the City Code on Takeovers and Mergers, it had until 1 February to submit a new bid.

It submitted a proposal for an all-stock deal earlier this month, in which every share in Entain could be exchanged for 0.6 MGM Resorts shares. This valued Entain at around $11bn (£8.08bn/€9.06bn), and would have seen its shareholders own 41.5% of the enlarged business.

However it was rejected by the Ladbrokes and PartyGaming operator’s board, which said it “significantly undervalues” the business.

MGM Resorts’ majority shareholder InterActive Corp (IAC) later announced its support for the proposal, pledging to provide up to $1bn to fund a cash proposal for investors not willing to exchange their holding for shares.

Each operator suggested that the failed takeover would have no bearing on the companies’ ongoing partnership.

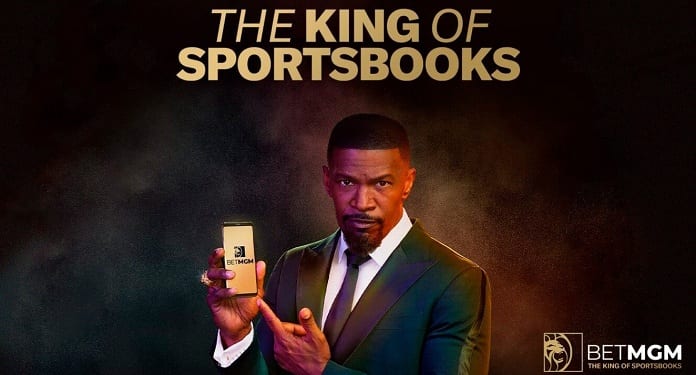

The BetMGM joint venture, in which each operator holds an equal stake, was established in 2018. It was supported by an initial $200m investment, with its total funding increased to $450m in July 2020.

When Entain made the proposal public, MGM Resorts said the combination would have allowed the enlarged business to accelerate BetMGM’s US growth. It would have also diversified the business’ operations across multiple channels and markets.

“BetMGM, our US sports betting and online gaming venture with Entain, remains a key priority for the company as we continue to leverage our preeminent physical gaming, entertainment, and hospitality platform to expand digitally,” Bill Hornbuckle, MGM Resorts International chief executive, said.

“We believe that BetMGM has established itself as a top-three leader in its markets and we remain committed to working with Entain to ensure its strong momentum continues as it expects to be operational in 20 states by the end of 2021.”

Entain, meanwhile, said it had a clear growth and sustainability strategy that was underpinned by market-leading technology, which it is confident will deliver “significant value” for stakeholders.

“We look forward to continuing to work closely with [MGM Resorts] to drive further success in the US through the BetMGM joint venture.”

Under Rule 2.8 of the City Code on Takeovers and Mergers, MGM Resorts said it reserved the right to set aside the decision not to follow up its interest under certain circumstances.

It would only make a new proposal or a firm offer with the agreement of Entain’s board, or if another business put forward a bid to acquire the operator.

If a reverse takeover was in the offing, or in the event of any other material change in circumstances, it could also return with a fresh offer.

Shares in MGM Resorts International are trading down 1.59% at $29.80 per share in New York on Tuesday (19 January), while shares in Entain are have fallen 16.59% to 1,179.0 pence per share in London.