ECJ rejects Stanleybet Italian tax complaint

Stanleybet has failed in its bid to have an €8m tax bill in Italy dismissed on the grounds of discrimination, following a ruling from the European Court of Justice.

The European Union’s highest court ruled that Italy is legally able to impose tax bills on overseas-based operators who take money from Italian customers.

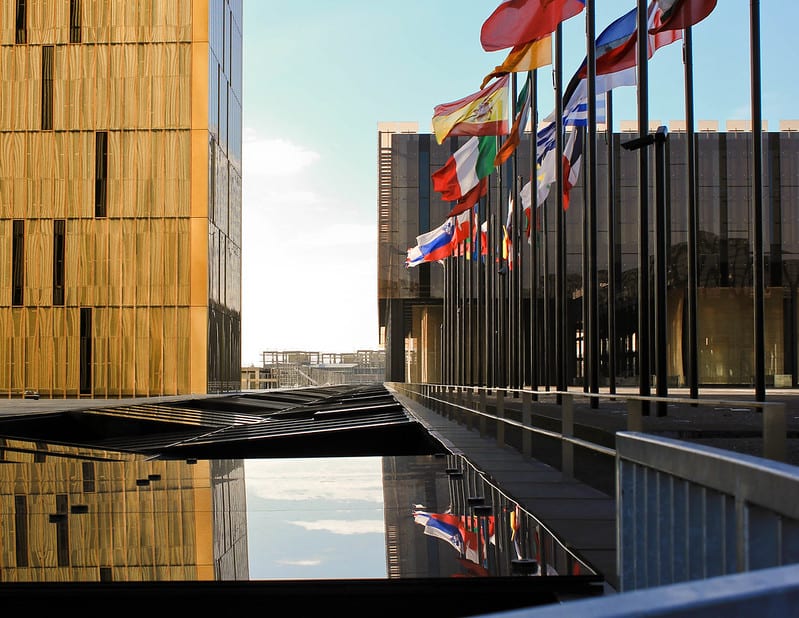

The long-running case, which dates back to 2016, was referred to the Luxembourg-based European Court of Justice (CJEU) by Italy’s tax authorities after Stanleybet Malta queried a tax bill based on transactions that took place between 2011 and 2016.

The court ruled on Wednesday that because the tax “applies to all operators who manage bets collected on Italian territory, without making a distinction on the basis of the place of establishment of those operators…the imposition of that tax on Stanleybet Malta cannot be regarded as discriminatory.”

While Stanleybet claimed it was being taxed twice – both in Malta and Italy – the court held that countries are not obligated to alter their own systems to ensure such anomalies within the EU do not occur. The five-judge panel said EU member states are allowed to impose taxes as they see fit, so long as the assessments comply with law.

Stanleybet is yet to comment on the ruling.

The Stanleybet taxation case will now be returned to the Italian national courts for a final ruling.

Stanleybet Group is present in Belgium, Cyprus, Denmark, Italy, Malta and the UK where it operates in B2C market with a total of over 2,000 branches and 3,000 employees. The group is also present in Croatia, Germany, Nigeria, and Romania, with its B2B brand, Magellan Robotech.

In 2018 Stanleybet lost its challenge against Italy’s lottery monopoly after the European Court of Justice ruled the country’s Customs & Monopolies Agency’s (ADM) model of issuing a single concession for the vertical was legal.

Image: katarina_dzurekova