California: forcing iPoker operators to ante up could backfire

California legislators must heed the lessons of Europe and resist the temptation to increase proposed tax rates for iPoker, while proposed amendments to the DFS bill fail to address key questions of constitutionality and tribal exclusivity raised by AB1437, argues Stephen Hart.

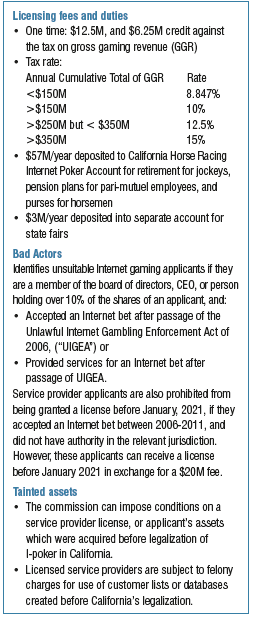

After six years of jostling among tribal governments and other stakeholders, significant amendments to California’s iPoker bill (AB2863) will resolve outstanding issues over bad actors, tainted assets, and the eligibility of horse racing associations for Internet poker operators’ licenses and more.

However, in spite of the progress that’s been made, with AB2863 now headed to the Assembly floor for a possible vote, having passed out of the Appropriations Committee in late June, plans by the California Legislature to increase the proposed iPoker tax rate threaten to drive consumers away from the industry.

At the other end of the spectrum, the young, unvetted Daily Fantasy Sports (DFS) market faces significant challenges.

AB2863 amendments mark turning point for California iPoker

Despite on-again, off-again negotiations among stakeholders, the need to allay fears of tribal governments over threats to tribal gaming, and address important consumer protection measures, amendments to AB2863 have finally brought iPoker legislation another step closer to becoming law.

Changes since February center around establishing tax rates, protecting consumers from corrupt operators, and promoting accountability as competitors vie for market share in a highly competitive field.

Changes to proposed tax rate threaten to unravel iPoker progress

In 2013, Indian gaming generated US$7.1bn in federal, state, and local taxes on secondary economic activity.

In California alone, tribal gaming accounts for hundreds of millions of dollars in state revenues.

Online poker could also emerge as a strong industry, but legislators must resist the temptation to set tax rates so high that customers turn to illegal, unregulated operators, setting the iPoker industry back after years of diligent effort to advance and protect it.

Poker operators generate slim margins and operate in a highly competitive market where marketing costs approach 30% of gross gaming revenue.

Increases in gross revenue taxes result in a direct reduction of marketing spend, thereby lowering the value proposition to the consumer.

Consumers can and will instantly move to other sites that pay no tax and provide better value – just one click and they’re gone.

As shown in Figure 1 (below), data from countries with regulated online poker shows that if tax rates are too high, the market declines as consumers shift to lower-cost black market operators.

This suggests that the policy objectives of AB2863 are best served by maintaining or reducing the current proposed tax rates.

DFS amendments barely scratch the surface

The California Legislation authorising Daily Fantasy Sports (DFS) is still in its infancy, and faces significant challenges. Serious doubts persist over possible violations of the California Constitution.

The Senate Committee on Government Operations was set to vote on AB1437 on this topic on Tuesday, June 28, but the item was removed from the agenda. Reportedly, legislators were asking why vote at all if it’s not constitutional?

But that’s not all. There’s also the issue of exclusivity. Indian tribes have exclusive rights to gambling operations in California.

Since participants use a computer for DFS, which is an electronic device, this may mean that DFS’s authorisation could violate the tribes’ exclusivity, costing the state hundreds of millions of dollars in lost compact fees. At the same time, the issue of state tax revenue from DFS hasn’t yet reached the table for consideration.

Although these questions remain, the following amendments have been made to AB1437:

- Licensed operators are prohibited from offering an Internet fantasy sports game based on a college or athletic event, or any event in which amateur athletes participate,

- Urgency Clause enables legislation to take effect immediately.

Patience will pay off

Getting iPoker legislation to the point it is now has been a long and winding road – one filled with challenges and compromises.

While it may be attractive to consider the promise of increased revenues from the lucrative iPoker market, increasing the tax rate above 15% or higher, as history and experience in EU jurisdictions have demonstrated, could easily have the reverse effect.

DFS, just at the start of the journey, is mostly undefined at this point, and requires greater study and collaboration to even get to the question of state tax revenues. Biding our time, doing the research, and staying patient may be the ace in the hole that’s needed.

Stephen Hart He has been representing Indian tribes since 1992 and is a partner and gaming practice group leader at Lewis Roca Rothgerber Christie LLP.